Santa Cruz Real Estate Great Debate

May 17, 2009

Spring has definitely returned to Santa Cruz! We’ve been having some incredible days, and I’ve been enjoying being a new dad here in town, cruising around with wife and baby in the stroller, around the neighborhood, over to Aptos Village Park, down to the Capitola Beach, West Cliff Drive, soaking it all in. It’s been an incredible what, almost six weeks now since Aiden was born?

I must admit, with all the fabulous weather and my beautiful bouncing baby boy to take care of, I’ve taken my eye off the real estate market somewhat. And that’s a good thing – truth be told, I’ve been working, on average, over 80 hours a week for nearly the past two years, and I think that for me, it’s not a sustainable pace. I reckon these days I’m down to something closer to 40-50 hours a week, which does leave some precious time to spend with my wife and amazing little man.

I think that many of us started off the year thinking there would be some Change, right? I think we were promised that, and for good or ill, change has come. Certainly, the real estate market has changed over the past month or two. If you are a subscriber to my newsletter, you may have noticed that last month (April 2009), the median price of housing in Santa Cruz has risen.

Well, I guess that puts the lie to me, right? Here I am saying no no, we’re not at bottom – and now we see rising prices? Scant months after I got up on my high horse and said, “Wait out the storm, ye long-suffering would-be buyers!”

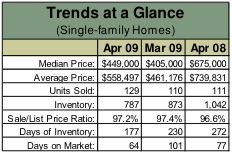

Let’s take a look at these numbers. First, the summary:

So from a median price in March of 2009 of $405,000 we have skyrocketed to a median price of $449,000 – nearly an 11% rise in a single month. Now let’s look at the breakdown of those numbers, divided up into different market areas in Santa Cruz county:

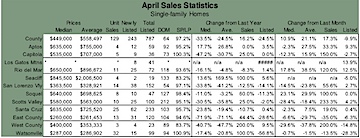

You’re going to have to click on the chart to open it up in a bigger window to actually read the numbers. Taking a closer look, you can see that in every market area except for Rio del Mar (Aptos) and Soquel, the median home price in April was lower than it was in March. Those two areas, however, showed such strong month-over-month gains that they did lift the entire median price up about 10.9% for the county as a whole over the month before.

Except for those two areas, every other market area in Santa Cruz county showed price declines. And let’s not blame it on Watsonville – Watsonville experienced the smallest price drop of all, just 0.7%. Capitola – down 12.3%, Scotts Valley, down 28.4% – and the West county (Bonny Doon, Davenport, Empire Grade, etc.) – down a whopping 28.6%.

Now, hold on a second. Let’s talk about lies, damned lies, and statistics. There is a chorus of voices saying that it looks like we’re hitting bottom – after all, the median price, county-wide, did just increase, right?

Nope, not really. The median price just decreased a whopping 33.5%. The truth is, it is pointless to look at one month compared to the month before, because there is a lot of seasonality in the real estate market. You really need to look at the year before to see how the market performed – and from the statistics, we can see the median home price, county-wide, is actually down 33.5% in April of 2009 compared to a year ago.

And some people are now saying the market is bottoming out?!

One thing that many folks from the “the market is bottoming!” camp like to point out is the number of multiple-offers some listings are receiving. It is true, the market for single-family residences priced under $400,000 is very competitive. Most of those properties in our neck of the woods are to be found in the Watsonville area, and there’s no lack of multiple-offer situations going on down there. There are also a lot of multiple-offer situations going on in San Jose and Salinas – I have a listing in San Jose where I got 34 offers (asking price: $349,900) and another in Salinas where we got a similar number (asking price: $149,900). Surely that means we’re at the bottom, right? Right??

Honestly, I am mystified how people can take a few anecdotes, completely ignore the state of the economy and the housing market as a whole, and now herald, with strident authority, that we are now at the bottom of the market and THIS, TODAY is the time to buy, or you will miss out on the chance of a lifetime.

It’s clear that the bottom is coming – there will be a bottom, someday, and prices will start to rise, eventually. And it’s true, we will only know it by looking in the rear-view mirror – which makes it impossible to say for sure that this is, or is not, the bottom of the market. What’s more, not all market segments will bottom at the same time, so there really is not truly a “bottom” so much as a series of different bottoms for different kinds of properties in different places.

Allow me to tackle the anecdotal evidence head-on. Again, many people point to these multiple-offer situations as evidence we have hit bottom. The thing is, there were many multiple-offer situations going on this time last year. Many. Why do you suppose that is?

I will grant you – there are more this year than last year – more properties getting multiple offers, and more offers getting submitted. Competition is, certainly, stronger this year. So let’s take a look at those charts again, at another key bit of information: the amount of inventory available.

Despite what you may have heard from certain interest groups (California Association of Realtors, National Association of Realtors, ahem), there is not a great selection of homes to choose from on the market. This time last year, there were 1,042 single-family residences available county-wide. Now, there’s just 787 available – that’s a drop of 24.5%. Simply put, there is a lot less to choose from this year than last year – creating more competition for those homes which are available. Good news for sellers, that’s for sure!

The overwhelming majority of these multiple-offer situations happen in the low end of the market – in Salinas, that would be under $250K, in Watsonville, under $350K, in San Jose, under $450K. What kind of homes are selling in these areas at these prices?

Bank-owned homes, that’s what kind. Only foreclosure real estate can sell at those prices. Well, that’s not true – short sales can also occur at those prices, and some people who have had their homes a long, long time may have enough equity in them to compete with all the REOs and short sales. However, I’d bet my bottom dollar that upwards of 75% of all of these sales are bank-owned “REO” foreclosure properties, probably another 10-15% are short sales, and the rest would likely be probate sales and whatnot.

As it happens, there is a distinct lack of REO inventory on the market right now – and again, at these price points, the vast majority of the market consists of REO properties. This inventory shortage comes just at the time when sales hit their peak – the hot time of our real estate market tends to be March through August, that is when more buyers are out shopping compared to the rest of the year.

So why is there a lack of REO inventory? Has there been some dearth of foreclosures, has the foreclosure crisis abated? Not hardly. Change has come, and during the transition, while all this TARP business and Making Home Affordable initiatives were getting going, the lenders had some self-imposed moratoria on foreclosures. That, and many states (including California) enacted laws to lengthen the time it takes to carry out a foreclosure – and that has served to really tighten up the inventory of these low-end properties.

These multiple-offer situations we are seeing now is simply the combination of a very constricted inventory coupled with the seasonal increase in real estate sales.

The good news for home buyers is that this, too, shall pass. The various moratoria have been lifted and the clock is already winding down on the laws lengthening the time it takes to foreclose on a property. What that means is that Notices of Default (the first step in the foreclosure process) are still near, at, or over record highs.

Here is what I predict – and I’m probably wrong, but I’m going to go out on a limb here. I predict that in 2-3 months, we will begin to see more REO inventory on the market. That puts us in the July-August time-frame. In 3-5 months, we will be seeing a lot more REO inventory coming onto the market – just at the time that the peak buying season is ending. We will see a significant increase in REO listings – and a continuing drop in real estate values, as supply once again exceeds demand.

Another interesting wrinkle is that many of these coming foreclosures are not bottom-rung properties. Many of these upcoming foreclosures are in solid, middle-, upper-middle, and wealthy neighborhoods. I wonder, what’s that going to mean for the market as a whole? Personally, I think it’s going to put increased pressure on the bottom of the market, as many people who were looking at buying a lower-priced “starter” home may now be thinking of stretching to go for one of these “premium” foreclosures which I expect we’ll be seeing.

And that doesn’t even begin to address the elephant in the room – the sad state of the local and national economy. There is a whole lot more to the picture than just the simple supply of foreclosures and demand for affordable housing.

So let the debate rage! We’ll see which way the chips fall, and I look forward to the market data from September, October, and November of this year. As the late Paul Harvey used to say – stand by for news!

Posted by Administrator at 1:01pm

Comments Off on Santa Cruz Real Estate Great Debate

Santa Cruz at Market Bottom? Some Say Yes, I Say No

March 18, 2009

I popped in my office this evening to pick up a commission check, and as I passed by a colleague’s desk, I happened to notice a photocopy of the front page of today’s Santa Cruz sentinel sitting there. I had actually seen the headline news flitter across my screen this morning, thanks to Twitter and Growl (very cool). However, I didn’t have a chance to read the article, and I didn’t see the sub-headline: “We are at Bottom says one Watsonville Realtor.” Or some such eye-bait.

One thing that’s interesting is that the median price the Santa Cruz Sentinel used, $380,000, is quite a bit lower than my own figure of $429,000. $380K is pretty low for these parts, but an almost $50K discrepancy between my numbers and those of Gary Gangnes (an oft-quoted source of local market data) is notable. But I won’t quibble with Gary, I think he’s been tallying the numbers since I was learning to ride a tricycle.

The exact median price for sales in February ’09 doesn’t interest me so much – the fact that it’s a lot lower than February ’08 or even January of ’09 is very interesting – the fact that we’re heading, still, in a downward direction seems inescapable.

However, one Realtor at least (and one who should know – the president of the Watsonville Association of Realtors) is ready to escape this, by proclaiming that in the south county, at least, “We’ve hit our bottom … in single family.”

She brings up a few vague anecdotes, like she has more buyers than properties right now. And that’s the criteria for knowing when we are at the bottom, when one Realtor has more buyers than properties? That’s not real hard thinking. She also cites how we’re seeing multiple offers. Fact is, we have been seeing multiple offers for well over a year now on these bargain-basement properties in Watsonville – and pretty much anywhere in California where bank-owned foreclosures are sold several percent cheaper than competing properties – these properties attract multiple offers and sell quickly. It’s not a new phenomenon, it’s been going on at least 18 months I’d say.

The fact is, I’ve got a number of listings in Watsonville myself. Do I have multiple offers on all of them? Hardly. Certainly, sometimes there’s a crazy feeding frenzy of 10+ offers on these properties. I listed a new home last night in San Jose, and I’ve had 20 phone calls on it today at least, I’m sure there will be multiple offers on that one. Does that mean the market has stabilized, that we have hit bottom?

No, it means that this is the cheapest home to sell in that neighborhood in that condition in many years, and there are buyers for it, lots of them. But when this home sells, the next one to come on the market will come on at a lower price, or at least, it’ll almost surely sell at a lower price. That’s because we’re in a declining market.

Here’s an anecdote that tells me we we are not at bottom. I have a listing at 90 Arista Lane in Watsonville, it’s 14 years old, 3 bedrooms, 1.5 bathrooms, on a quiet dead-end street in the center of town, close to everything. All the homes on Arista Lane and Arista Court are pretty much identical. My own listing is not in bad shape at all, except it does have some unusual choices for interior paint color.

The house across the street from this, 87 Arista Lane, is what you’d call a “model match.” Pretty much – I didn’t go into 87 Arista when it was on the market, but from what I can tell on the MLS from the pictures, the choice of paint colors and level of amenities in this home was about on par with my listing. 87 Arista was listed in October of 2008 for $299,900, and in November of ’08 it went down to $279,900 before closing escrow on January 2 of ’09 for $260,000. There was no mention made of the seller having paid the buyer any closing cost credits – but not all Realtors mention the closing cost credits in the private comments when marking the property sold (though they should).

And then, a scant two months later, my own listing comes on with an asking price of $250,000 – that’s 3.8% less than the sale price of a very very comparable property which closed just two months earlier…and I’m on the market eight days, and I’m standing in a field of chirping crickets. Not an offer, and only a handful of phone calls. Where are all these buyers, loan approval letters in hand, waiting to buy my listing that could possibly be had for maybe 6-7% less than this comp which closed just a tad over two months ago?

Let’s say though that 90 Arista Lane does get a full price offer (very unlikely if there’s only one buyer making an offer), and it sells for $250,000. By the time it closes escrow, it’d be about 3 months past the sale of the last comp, meaning the market will have dropped about 1.26% per month (for this particular type of home). That’s an annual rate of 30% drop. And, strangely enough – the year-over-year price decline (February 2008 to February 2009) in Watsonville was…30%. But mind you, we are now looking ahead to March, so what we’re seeing is…the market is still headed down, at about the same rate as it’s been going down for the last year.

And another thing! Before I close out this little missive, I’d like to take exception to another thing in the Sentinel article, that homes are being sold “at discounts of 30 to 50 percent.” Nothing could be farther from the truth. The truth is, these homes are being sold at a loss of 30 to 60 (yes – sixty) percent from their all-time peak values. In fact, these homes which receive multiple offers typically end up selling for more than asking price – so does that mean that anyone who pays more than list price is paying more than the property is worth?

No, it doesn’t mean that at all. It means that the list price was below market value, and the market recognized that and enough offers were generated to bump the price back up to market value – or perhaps a bit above market value, or perhaps a good bit below. But not too far below – if in fact you were able to buy a home for 10% below true market value, you could not do a thing to the property, then turn around and sell that property to someone else the next day for 10% more than you paid for it. I can name few examples where that has happened here after purchasing the home “retail” on the MLS in recent memory.

Since Paul Harvey is no longer with us to say it, I’ll have to: “So now you know…the REST of the story!”

Posted by Administrator at 8:29pm

Comments Off on Santa Cruz at Market Bottom? Some Say Yes, I Say No

Santa Cruz Realtor and Devil’s Advocate

March 10, 2009

I find myself doing it all too much, but I feel compelled to do it again…I must apologize for not keeping my blog updated. There’s a few reasons for that – no excuses, of course, just unvarnished reasons. One biggie is that I am completely and utterly swamped with work, and while my blog is actually very important to me, it falls into the “important but not urgent” quadrant of McCovey’s “first things first.”

Another reason I haven’t written anything is that I don’t know quite what to say! Every day, I read the newspapers and the blogs and e-zines and and I watch TV and listen to podcasts, absorbing all the real estate news that there is, and I try to make sense of it all, I try to wrap my head around it and come to some kind of conclusion that I feel certain enough about to write up a blog entry, sharing my thoughts with you all…

I guess I just keep looking for that ray of sunshine. I think you can read lots of sunny Realtor blogs, about how great a market it is for buyers right now. That may be true, but I’m not buyin’ it. I don’t think it’s that great of a market out there for buyers, because there simply isn’t that much to chose from. Not here in Santa Cruz, anyway. Just check out my Santa Cruz Real Estate Sales Data page and you’ll see.

If you’ve read my newsletter, you know the facts – that the sales volume has risen in Santa Cruz for the eighth month in a row. No if, ands, or buts about it – that’s good. However, that goes along with, I believe, eight months of declining home prices. The Santa Cruz county median in February 2009 was down to $429,000 for a single-family residence. I believe that at the height of the market a couple-few years back, the median was around $834,000.

The optimists in the crowd will also point to months of falling inventory – this time last year, there were 989 single-family residences for sale in the county, and now we’re down to 803. With a monthly sales rate of 87 units in February, we’re looking at a 9.22 month supply, and a year ago, we were looking at a13.36 month supply of homes for sale. The theory is that as the supply tightens and demand increases, prices will stabilize.

Except, of course, that hasn’t been happening these past eight months. Sales have been rising (the “demand”) and the inventory has been shrinking (the “supply”) – but prices have continued to drop, steadily.

I think an important thing to consider in all of this is that the inventory is not shrinking so much because of the high sales volume, but rather it is shrinking also because many sellers are letting their listings expire, or just outright canceling them, taking their homes off the market. Sellers are giving up in frustration, and this is a big reason why the inventory continues to shrink.

I feel this contributes to a false impression of the real estate of the market. I think there are a lot of sellers who want to sell, but right now they are sitting pat. Many of them will not be able to sit pat forever, and will eventually bring their properties back on to the market – at still lower prices. I think there is a huuuuge shadow inventory out there of would-be sellers who, one day, will be pushed by circumstances back onto the market.

Perhaps they’ll lose their jobs – after all, California unemployment now tops 10.1%. In Santa Cruz, I believe unemployment is now 12.6% and in Santa Clara county (the Silicon Valley, the fountain from which much of our wealth flows) is now at 9.4%. Perhaps they’ll just fear they’ll lose their jobs, and want to sell their property and get out of their crushing mortgage payments before they are forced into the unemployment lines.

Where am I going with all of this? Nowhere in particular – that’s why I haven’t written a blog entry in a while! I hardly know what to make of it all. I will say this, though: don’t buy into the idea that this is a great time to buy. It’s a great time to buy over-priced real estate. It’s quite a bit more challenging to buy real estate today that you won’t regret having paid so much for a year from now. After all, when Warren Buffet says the US Economy has fallen off a cliff, it may perhaps be taken as a harbinger for our local real estate values as well.

Posted by Administrator at 11:14pm

1 Comment »

Santa Cruz home sales rising, prices falling

February 15, 2009

The February 2009 edition of my newsletter is available, and once again I give you the skinny on the Santa Cruz Real Estate market for the previous month. As has been the case for several months, there is a bit of good news – the sales volume (number of houses, condos, etc., which have sold) has increased for the seventh month in a row, year-over-year.

Unfortunately, sales were not up month-over-month; in December of 2008, there had been 112 sales of single-family residences in Santa Cruz county; in January ’09, that number had sunk back down to 79. It’s normal, though for January sales numbers to be quite a bit lower than sales in December. The important thing to look at, I feel, is the year-over-year gain or loss, and this year, sales were up a whopping 21.5% from January 2008.

The median price of a Santa Cruz home, however, continues its march downward, but at a slower pace than for most of 2008. The median price for January sales of single-family residences was $445,000, compared to $452,500 in December 2008. However, the median price in January 2008 was $610,000, representing a year-over-year price drop of 27%. Ouch.

It’s an interesting market, that’s for sure. If you watch TV or listen to the radio, you may have heard a commercial or two from the National or California Association of Realtors telling you this is a great time to buy, that there are a lot of homes for sale. In Santa Cruz, this is patently not true. There are not many homes for sale at all – the amount of inventory is down 21.6% from January a year ago, and inventory has been declining for nine straight months.

This low inventory, however, is not a result of blistering sales figures. Rather, inventory is low for one simple fact: this is a terrible time to sell your house in Santa Cruz, and sellers know it. There are many people who would like to sell their homes, but fear they will face a market of buyers with their knives out.

And, they are right. Buyers are definitely looking for a bargain. Any seller which wants to sell their home needs to ask themselves a simple question: can I wait to sell my home for, oh, 3 years? How about 4? It could easily be that long before prices are higher than they are today. If you have a house you need to sell in the next year, or even two, I have a hot tip for you: sell now. Price it under market to generate multiple offers, get over asking price, and get that property sold. Even though the market is dropping, your house is, right now, worth more than it’s going to be for some time to come.

Posted by Administrator at 9:02am

Comments Off on Santa Cruz home sales rising, prices falling

Is 2009 The Year to Buy Santa Cruz Real Estate?

January 17, 2009

This is a question that I get asked, and find myself asking, quite a bit these past couple of weeks. I am working with a number of buyers who are skittish and waiting for prices to hit just the right point. After all, what’s the sense in buying a depreciating asset? Who wants to buy something that they know is going to lose them money – maybe a lot of money – within a few months after buying it?

One of my clients sent me a link to a great web site – Housing Crash Continues, Bubble Pops. It lists 14 great reasons why this is a terrible time to buy real estate. It’s pretty strong stuff, with lots of inflammatory statements like, “Realtors just lie outright about…”. Well, I always say, never attribute to malice what can be explained by stupidity. I don’t think that Realtors are habitual liars, but it’s true that many of us are not as perhaps informed as we might be.

I won’t address all 14 points that the The Housing Crash guy brings up, but I would like to make a few comments. The Housing Crash guy says:

A landlords’ rule of thumb is that a house price should be a maximum of 15 times the annual rent for that place, yet in coastal areas, houses are still selling for 30 times annual rent

I think he’s got a good point there – which goes to underscore my belief that prices in Watsonville are actually very reasonable at the moment. Looking at Craig’s List rentals for Watsonville, I see you can rent a 3-bedroom condo in Apple HIll for $1,875 a month. Those condos are now selling for around $190,000. So at $1,875 a month, that’s $22,500 a year, or $337,500 over 15 years. Hmm…so does that mean according to the Crash Guy, we should all be moving to Watsonville?

Put another way, how much does it cost to own that same condo which rents for $1,875 a month? Let’s say you put down the minimum 3.5% as required for an FHA loan, and that you are paying 5.75% interest per month, which includes the allowance for the FHA insurance. You’d need a down payment, then, of just $6,650, and you’d have a loan of $183,350. Your fully-ammortized 30-year loan payment would be about $1,070 per month. Then you’d have property tax of about $175/month, and then of course your HOA fee for that unit of about $290/month. That comes to $1,535 per month. Hmm. It costs less to buy in Watsonville than to rent.

I know, I know – you don’t want to live in Watsonville. You’d rather pay a premium and live near the beach, or closer to your job in Silicon Valley, or closer to your friends who all live near downtown, or maybe you don’t want to live in Watsonville because you’re spooked by los pandilleros, or you want your kids in a better-performing school district. Whatever your reason, I can accept that you might be interested in buying somewhere other than Watsonville (even though I think real estate there is a an exceptionally good value at the moment).

We all know that prices in Santa Cruz are a lot higher than in Watsonville, but let’s see some examples. Let’s start by looking at Craig’s List rentals in Santa Cruz. Wow, they’re a lot higher than in Watsonville! Thank Goodness for UC Santa Cruz, drivin’ that rental market right through the roof, eh landlords? Looking over the ads on Craig’s List, it’s safe to say that a 3 bedroom, 2 bathroom house would rent for about $2,400 a month in Santa Cruz, assuming it was in a not-so-great location. That’s a pretty conservative assessment, having looked at what’s available.

At $2,400 a month, that’s $28,800 a year – times 15, that’s $432,000, which is the maximum that The Crash Guy says you should pay for a house if it rents for $2,400 a month. Are there any 3/2 houses in Santa Cruz for $432,000? No, of course not! Don’t be silly. But there are presently six 3-bedroom, 2-bathroom houses in the city of Santa Cruz under $500,000.

Does that mean that housing prices are still too high in Santa Cruz? According to the Crash Guy – yes. According to me – yes. I do think that prices in Santa Cruz (and Capitola, and Soquel, and Aptos, etc.) are higher than they will be towards the end of the year. Does that mean you shouldn’t buy a house in Santa Cruz in 2009?

Good question. Let’s look at the payment for a $500,000 house – but let’s assume you’re putting down a reasonable 10% instead of the FHA minimum of 3.5% – so you’d have a $450,000 loan, again at about 5.75% because with only 10% down, you’d still need to pay mortgage insurance. A 30 year fixed loan at 5.75% would run you $2,626 a month – plus $458/month in property tax, plus about $75/month for insurance, leaving you with a monthly payment of about $3,159.

However, you mustn’t forget about your mortgage interest tax deduction – of that $2,626 per month, about $2,100 is interest (gulp) – plus the $458 in property tax (which is also deductible), means you have a monthly tax deduction of $2,558. Let’s say you’re in a tax bracket of 25%, and you can figure you’d save about $640/month in federal and state taxes, bringing your effective monthly after-tax payment to about $2,519 per month, or just about $120 more than renting.

Is $120/month too high a price to pay for the benefits of ownership vs. renting? You tell me.

Here’s what I will tell you: it seems clear to me that there are many properties in Santa Cruz county which now make economic sense to buy, and that number is increasing, and will continue to increase throughout the year. There is no shortage of blogs to read (try here, and here, for example) suggesting prices will continue dropping beyond 2009. I admit – quite possibly, this is true.

However, I would argue that if you want to live in Santa Cruz, and you have the option of either renting or buying, that for many people, the numbers will soon pencil out to where buying may, in fact, be the right choice for you in 2009. There. I’ve said it. But I won’t be offended if you want to take that with some salt on the side.

Posted by Administrator at 11:47am

Comments Off on Is 2009 The Year to Buy Santa Cruz Real Estate?

Blog Entries

Blog Entries